Are Cinema stocks dead?

Friday, October 9, 2020 by Finshots

Cinema halls are opening up next week. And so we thought maybe it’s time to look at India’s largest movie chain PVR and see what’s happening down there.

The Story

Here’s a secret probably no one told you. PVR and its ilk don’t make a whole lot of money by screening movies. Instead, they extract boatloads of money from popcorns and sodas. For instance, occupancy rates generally hover anywhere between 30–35%. Meaning on most days, they can’t even fill half their seats. But last year, the company made close to ₹948 Cr. selling food and beverages (F&B). That’s a lot of money. But it gets better. PVR only spent ~₹260 Cr buying this stuff. That’s a markup of 260% — a very profitable endeavour indeed.

In fact, the company would be loss-making if it weren’t for the sodas and popcorn. Also, the combos that you see plastered prominently on advertising boards inside. Yeah, that’s a ploy to get you to spend more money. So even if you didn’t want that Coke to go with your popcorn you might just buy it anyway because — “Hey, its value for money.”

It’s a tried and tested formula to increase what companies call — “Spend per Head (SPH)” i.e. the average amount spent by each customer on a single visit buying food and beverages. And in the last 5 years, SPH at PVR has increased from ₹64 to ₹99 (FY20). But that’s not all. SPH as a proportion of average ticket price has increased from 36% to 49%. Meaning spending on popcorn and sodas have outpaced the increase in ticket prices.

But that doesn’t mean PVR can abandon movies entirely and just focus on selling food. If the content pipeline is bad you won’t see as many people frequent the theatres. Who buys the popcorn then, huh?

So success in the film exhibition business is heavily dependent on the flow and quality of movies. Good content almost always guarantees better footfall and PVR like any other multiplex is at the mercy of filmmakers and audiences alike. Take for example what happened in 2015.

During the year, the company entertained fewer patrons simply owing to the fact that big-budget movies had failed to impress. And despite their best attempts to shore up financials, revenues tumbled and they were unable to reign in expenses. Profits fell from ₹50 Cr to ₹20 Cr and it was a disappointing year overall. So while you could suggest that the company makes most of its profits from the F&B segment, it’s also prudent to note that the likes of PVR can’t make money off of popcorns if people don’t walk into movie halls.

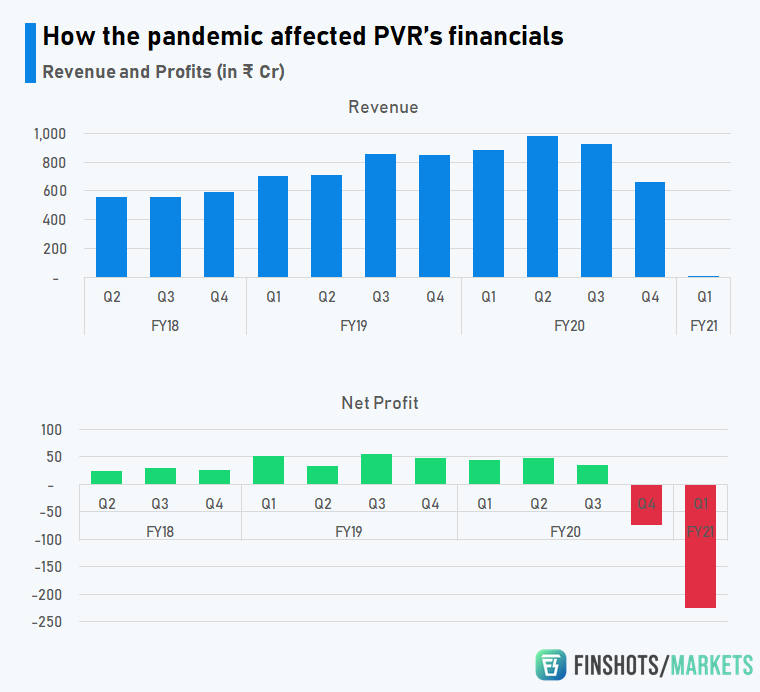

And that’s precisely what happened when COVID made landfall. Between January and March, the company made losses of 74 Crores. This despite the fact that cinemas were only shut for the last 15–20 days. Things got worse between April and June when revenues fell by 98%. The 2% came from bank deposits and some fringe distribution rights. Inevitably, losses mounted to ₹226 crores. To put that into perspective, PVR has never earned a yearly profit of ₹200 crore in its lifetime.

And while the company tried to rein in expenses by cutting jobs and negotiating with their landlords (to save on rent), it wasn’t enough to prevent a meltdown of sorts.

Also with the proliferation of OTT platforms (like Netflix and Hotstar), there is a very real risk that movie theatres might actually become redundant. In fact, many people have already proclaimed the death of cinemas. So is it possible that PVR might never recover?

Well… That claim is slightly dubious. As we wrote in one of our articles last year —

Consider for instance what happened with IPL. During the first season, there was considerable fear that IPL would have a detrimental impact on theatres. The rationale was that people would now spend less time going to the movies and this, in turn, would affect occupancy rates. These claims weren’t completely unfounded as in the early days, producers tried to stay clear of the IPL season. But as movies started coming out thick and fast, producers were left with little choice but to release them during the dreaded summer months. However, much to their surprise the move did not have a material impact on movie turnouts, instead, in almost anticlimactic fashion, IPL served as a platform for actors to promote their new movies.

This point is best summarized by the Chief Content Officer at Netflix, Ted Sarandos.

“Back in the day, people used to say video stores would kill theatres, now they assume streaming sites like Netflix will be the death knell. In hindsight, video stores actually saved cinema. It introduced new filmmakers and artists who were previously unknown. People always worry about how something is going to hurt when they should be focusing on how it is going to help. What it helps is the ecosystem of movie-making”

Now we are not stating that OTTs will have some miraculous positive effect on movie theatres. In fact, in all likelihood, there will be added pressure since producers and movie studios will now start trying to limit the theatrical window. It’s the period during which a movie plays exclusively in theatres, before being released on DVD or digital media. And as this window shrinks, the likes of PVR will be at an obvious disadvantage. After all, part of the appeal about a movie is the exclusivity and the hype. So if new releases make their way into your streaming sites faster, you’ll have fewer incentives to visit the theatres and this doesn’t bode well for the industry. But that doesn’t mean OTTs will kill theatres overnight. There will always be a certain appeal about going to the movies and it’s quite likely that both OTTs and Cinemas can co-exist in this world.

The only question, however — When will things normalize? Especially considering OTTs have gained a lot of ground since March.

Well… That’s a difficult question to answer.

Cinemas will finally open on October 15th. However, it’s a phased opening of sorts with some obvious restrictions. For starters, there’s a limit on occupancy rates. Occupancy rates can’t exceed more than 50%. And if you’re thinking that PVR has nothing to worry about since they only have occupancy rates of 30-35%. Well, that assessment is slightly dodgy. For instance, occupancy rates can go as high as 60–70% during big releases. So this will obviously affect them. It’ll pull the average down by virtue of simple arithmetic. Also, they will have to implement strict SOPs including cleaning and sanitizing halls after every show, offering protection kits to the staff, cleaning places with frequent touchpoints, etc. This might push costs higher. But perhaps the biggest concern is surrounding patrons. Are people finally ready to visit movie halls? And if so, how many?

So we ask you, fellow reader. What do you think? Do you think PVR will be up and running by the end of this year? Let us know your thoughts on Twitter.

Also, you can share this article with your friends and family on WhatsApp or Twitter.