It’s All Gas

Friday, October 14, 2022 by Finshots

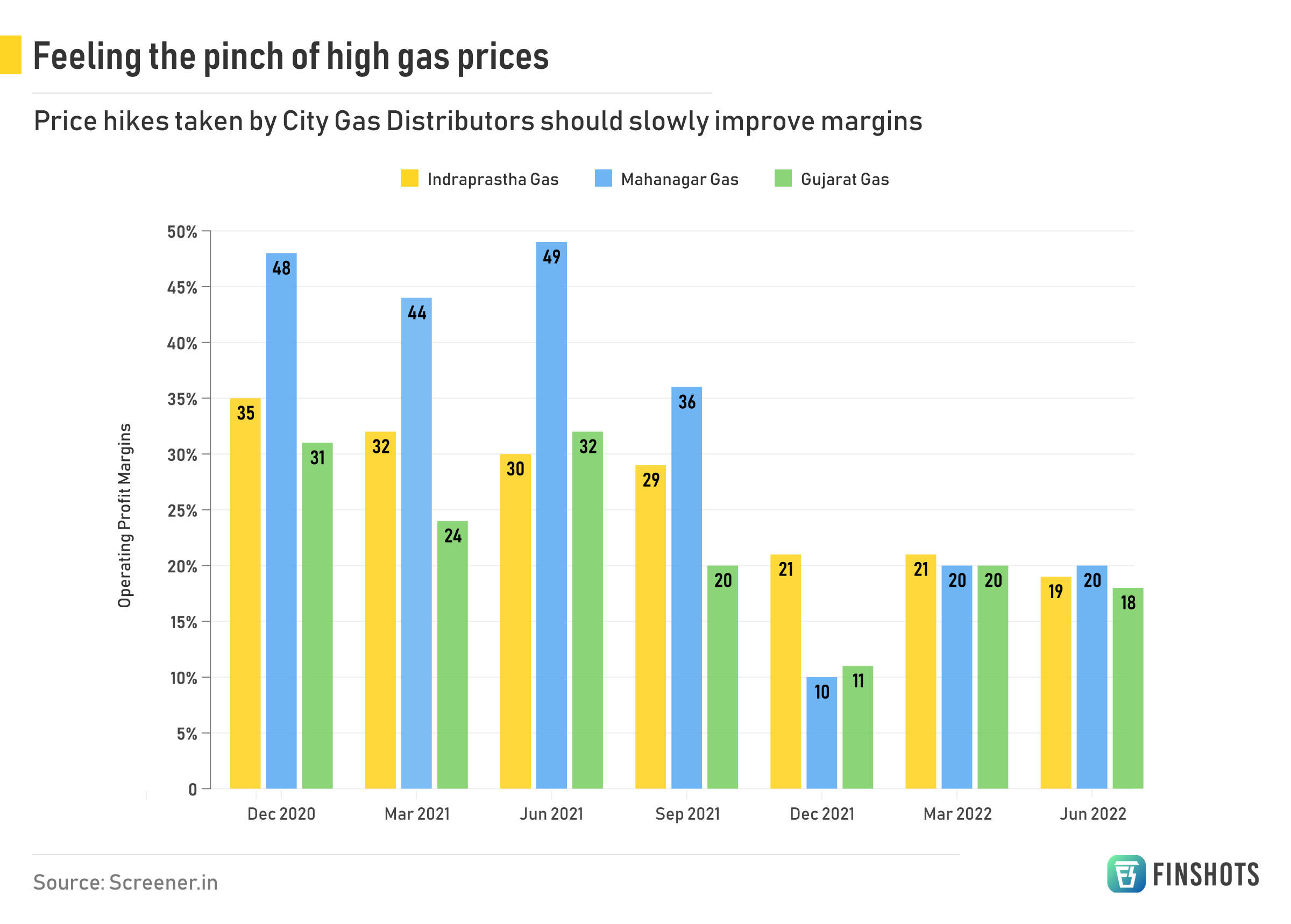

In today’s Finshots, we offer a simplified explanation of why gas distribution companies like Indraprastha Gas and Mahanagar Gas are feeling the pinch these days

The Story

A couple of weeks ago, I was travelling to meet a friend in Bengaluru and I noticed the driver scoffing at the price of Compressed Natural Gas (or CNG). I quickly checked my phone to confirm and there it was — prices were on the rise. In fact, the price had risen by a whopping 80% in just one year.

But then I noticed something else. I live in an apartment complex with a piped gas network, and I noticed my bills were rising too. In fact, PNG (Piped Natural Gas) prices have soared by nearly 100% in the past year.

So what’s going on here, you ask?

Well, some of it has to do with Russia. The country is the largest energy exporter in the world. But after the Ukraine invasion, Russia became a pariah of sorts. Many countries decided to isolate Moscow and Europeans in particular began scaling back their gas imports quite quickly. Naturally, they had to source gas from elsewhere. And they turned to the Middle East. But gas producers here couldn’t crank up production overnight, which gave way to a demand-supply mismatch. This mismatch in turn pushed gas prices higher.

And here we are.

Now there is a caveat here — India meets 50% of its demand through domestic production. This comes from state-owned gas fields. But domestic prices in India are regulated since most Indians depend on gas, one way or another. So in a bid to make gas accessible to most people, the government keeps a lid on prices.

And every 6 months, they revise the price of domestically-produced natural gas. It looks at the global rates, does some calculations of its own and says, “Okay, here is the Administered Price Mechanism (APM) rate for gas”.

But, there’s only so much the government can do with prices. If they keep domestic prices too low, it doesn’t incentivize producers to invest in the future, especially if they don’t have any semblance of parity with global producers.

So despite keeping a lid on prices, the government still often revises the APM upwards when global prices shoot up. For instance, it increased the prices by a whopping 110% on 31 March. And another 40% on 1st October. This took gas prices to record highs in India!

Now, domestic gas producers (ONGC etc) absolutely love it. The higher prices pad their coffers quite nicely.

But the protagonists of our story, the City Gas Distributors (CGDs) — the likes of Indraprastha Gas and Mahanagar Gas don’t enjoy this quite as much. These entities buy gas from Oil Marketing companies and deliver it to homes and fuel stations. And they can’t always pass the price hike to consumers.

Why? you ask.

Well, it hurts their volumes. They’re competing with other sources of fuel and when the gap between the prices of petrol and CNG dissipates, it becomes harder to sell gas. So they are wary of increasing prices willy-nilly. And they may often take the hit themselves, just to keep volumes high.

But their problem isn’t just limited to the price hikes.

See, back in 2014, the government changed its gas allocation policy. It prioritized companies involved in CNG and PNG distribution. So in some ways, the subsidised APM gas first went to gas distributors.

But in the past few years, domestic APM gas production has been on a decline and it has simply not kept pace with the growing demand. So despite being on the priority list, they’re still having to rely on more expensive, imported international gas to meet demand. And this hurts their margin even more.

It’s no wonder then that their stock prices have slumped by nearly 30% in the past year.

This brings us to the final question — what’s next for gas companies?

Well, the government has been trying to address some of these issues.

- It has recently increased the APM gas allocation to city gas distributors — from 85% to 94%. So the likes of Mahanagar Gas can source more price-controlled gas

- Also, since May 2022, they’ve handed over a mandate to the Gas Authority of India Ltd (Ltd) to source gas from ‘domestic difficult fields’ i.e the deepsea ones. Now bear in mind, this gas will be priced at a premium over APM gas, but the government can exercise some degree of price control since it’s still domestically produced gas. This could replace some of the higher-priced imports that City Gas Distributors have been relying on so far.

But wait — Isn’t this a temporary fix? If the country isn’t producing as much cheap gas, then we should have alternatives in place no?

Well yes. We are exploring new gas fields in India. Reliance is currently cranking out gas from Asia’s deepest gas field called the KG D6 block along the Bay of Bengal. And as a company, they expect to meet 15% of India’s gas demand by 2023.

Gas distributors could also lock themselves into long-term contracts with private gas fields in India or even global producers. This could give them some clarity on pricing. Finally, you have to remember that these companies are virtual monopolies. Take Mahanagar Gas for instance — They say they’re the sole authorized distributor of CNG and PNG in Mumbai.

Yes, this exclusivity period will end soon. But they’ll still own the infrastructure. They build the piped networks and it isn’t easy to replicate this. So even if other distributors join the fray, the likes of Mahanagar will always be able to command a license fee from these late movers.

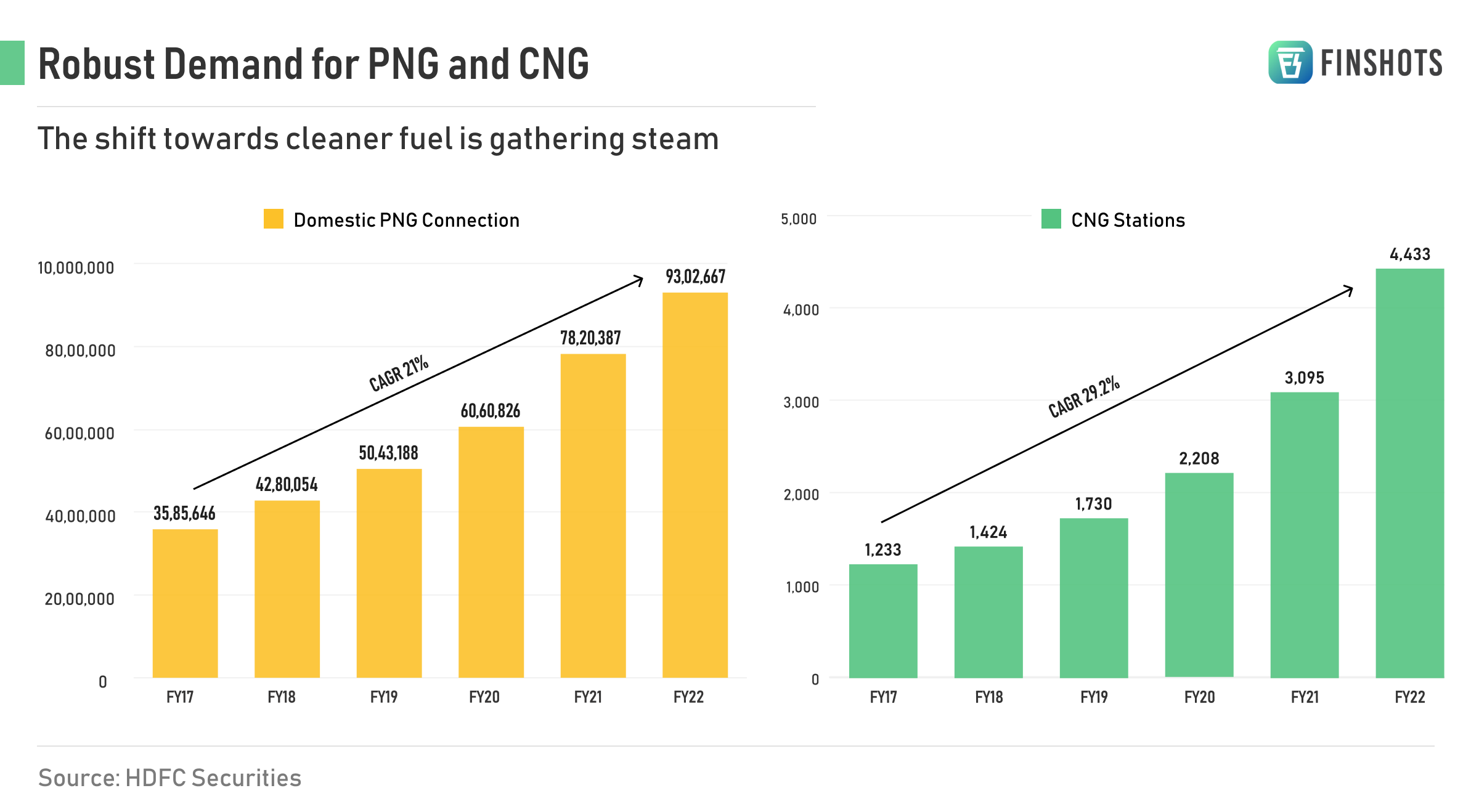

And if you think about it, CNGs and PNGs aren’t going anywhere. The government wants to double the share of natural gas in India’s energy basket — from 6.7% today to 15% by 2030. And the demand is already robust. According to HDFC Securities, PNG connections have risen 21% annually during the last 5 years. CNG fuel stations have jumped 29% each year.

So yeah, they’re in a tough spot right now, but the natural gas scene in India has only just begun playing out.

Will the traditional city gas distributors dominate the future? Or will their fortunes continue to tumble? You let us know.

Until then…

Don't forget to share this Finshots on Twitter and WhatsApp.

Ditto Insights: Why Millennials should buy a term plan

According to a survey, only 17% of Indian millennials (25–35 yrs) have bought term insurance. The actual numbers are likely even lower.

And the more worrying fact is that 55% hadn’t even heard of term insurance!

So why is this happening?

One common misconception is the dependent conundrum. Most millennials we spoke to want to buy a term policy because they want to cover their spouse and kids. And this makes perfect sense. After all, in your absence you want your term policy to pay out a large sum of money to cover your family’s needs for the future. But these very same people don’t think of their parents as dependents even though they support them extensively. I remember the moment it hit me. I routinely send money back home, but I had never considered my parents as my dependents. And when a colleague spoke about his experience, I immediately put two and two together. They were dependent on my income and my absence would most certainly affect them financially. So a term plan was a no-brainer for me.

There’s another reason why millennials should probably consider looking at a term plan — Debt. Most people we spoke to have home loans, education loans and other personal loans with a considerable interest burden. In their absence, this burden would shift to their dependents. It’s not something most people think of, but it happens all the time.

Finally, you actually get a pretty good bargain on term insurance prices when you’re younger. The idea is to pay a nominal sum every year (something that won’t burn your pocket) to protect your dependents in the event of your untimely demise. And this fee is the lowest when you’re young.

So if you’re a millennial and you’re reading this, maybe you should reconsider buying a term plan. And don’t forget to talk to us at Ditto while you’re at it.

1. Just head to our website — Link here

2. Click on “Book a FREE call”

3. Select “Term Insurance”

4. Choose the date & time as per your convenience and RELAX!

Our advisors will take it from there!