Finshots Markets — The IRFC IPO

Saturday, January 16, 2021 by Finshots

The Indian Railways Finance Corporation is gearing up for an IPO and while we don't usually do Sunday emailers, many people had requested us to cover the issue. So in this week’s Finshots Markets, we look at the company and see what they are up to.

The Story

Indian Railways is a corporate phenomenon. It’s a public sector undertaking whose influence reaches every nook and corner of India. It caters to an almost staggering population. And running this massive empire is no easy feat. Multiple entities come together in a bid to facilitate seamless business operations. And one company that’s perhaps indispensable to this cause is IRFC (Indian Railways Finance Corporation).

The company is responsible for financing the railways’ massive operation. But at the crux of it all, IRFC is a government-owned NBFC that caters to only one client — The Indian Railways and its many subsidiaries. Their usual course of business involves financing Rolling Stock. Think of it as a collective term that refers to anything that moves on railway tracks. It could be locomotives (engines), freight wagons, passenger coaches, railroad cars — that kind of stuff. And while the government does in fact have an internal fund set up to facilitate some of this spending, it’s not always enough. They need more and that’s where IRFC steps in.

Now, most people think IRFC extends loans to the Ministry of Railways (MoR) — especially considering IRFC is an NBFC and all that. But that’s not how the company conducts its business. Instead, they buy the rolling stock directly and lease it to the MoR. They transfer both the ownership and the risk associated with said assets for the duration of the lease, which usually lasts about 30 years. During the first 15 years, the company receives lease rentals biannually which pays for both the principal and the interest associated with financing the asset purchase. And afterwards they receive a nominal amount of 1 lakh every year, during which IRFC recovers the entire value of the asset and then some. At the end of the lease term, MoR buys the assets for Rs. 1 as a formality.

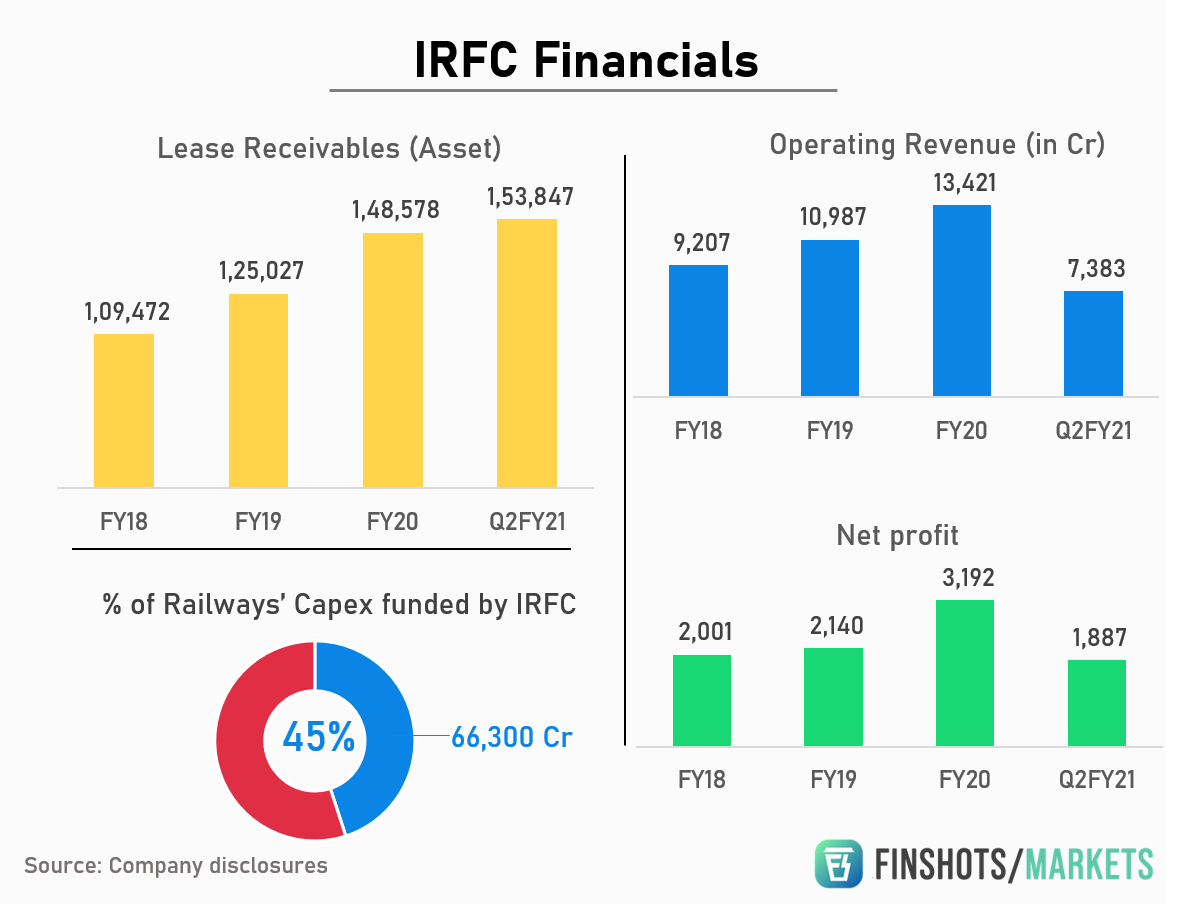

And while the arrangement sounds simple enough, the scope is still quite staggering. Right now the MoR's internal funds facilitate about 25–30% of the spending. And about 35–50% of the outlay is financed using IRFC. For instance, during FY 2020, IRFC funded 45% of the total capital expenditure. This added up to 66,000 crores. That’s a lot of money. The only caveat — They can’t profit excessively from the arrangement either.

Most lease agreements don’t carry high-interest rates. If the IRFC borrows money at 6% for instance, then they might try and get an extra 0.3%-0.45% from the MoR. More importantly, the government can restructure the lease arrangements if the obligations become a bit too overwhelming. So despite IRFC's seeming importance here, it can’t resort to excessive profiteering. But having said that they don’t just make money off of rolling stock. They also finance development projects including decongestion/expansion of tracks and electrification of railway lines. Once again, IRFC develops the assets for Indian Railways and then leases them to the MoR.

Together, all of these businesses have performed reasonably well. IRFC’s revenues have grown by 45% between 2018 and 2020. And right now the company’s top line stands at 13,400 crores. Even net profits surged 59% — From Rs 2,000 crore to Rs 3,192 crore and considering they have a monopoly in tending to the railways, nobody expects this status quo to change.

But then again, the monopoly status cuts both ways. If the railways don’t make progress, IRFC doesn’t make money. So the fate of the company pretty much rests on the progress Indian Railways can make over the next decade or so. However, some people aren’t too concerned about this bit. To date, the Indian Railways has deployed 289,185 freight wagons, 74,003 passenger coaches, 12,147 locomotives and a total running track of 95,981 kilometers across the country.

And they’re just getting started. Despite the massive progress we’ve made so far, the rail infrastructure in this country is woefully inadequate. So the popular consensus is that the spending will continue and IRFC will have to continue financing this bit.

So clearly, there is some upside potential here. But to reiterate a point we already made earlier — It’s still a largely government-owned enterprise that will probably continue to look after the interests of the Indian Railways first and foremost. The point is, the government’s interests might not always align with the shareholder’s interests. So if you’re looking to subscribe to the IPO you have to remember this fact.

But that bit aside, IRFC is still a very solid enterprise with some pretty looking financials. So we wrap this article by posing the final question to you — Are you subscribing or are you not?

Let us know your thoughts on Twitter.

Know anyone who would like to subscribe to this IPO? Share this article with them on WhatsApp or Twitter.