The ups and downs of being VIP

Friday, January 27, 2023 by Finshots

In today’s Finshots, we explore whether VIP Industries is in a sweet spot to capture the tailwinds in the luggage industry

The Story

Two things are happening in a big way in India.

- Revenge travel is in full swing. On 24th December, we witnessed the highest-ever domestic air passenger traffic of 4.35 lakh people flying on a single day. The previous high was in December 2019 when 4.20 lakh passengers took to the air. More frequent short holidays, group tours, it’s all happening.

- Wedding bells are ringing. During November and December last year, 32 lakh weddings were scheduled to take place in the country. That alone would have generated ₹3.75 lakh crore worth of businesses for the industry — 50% higher than in 2019.

And when these two industries see a growth spurt, there’s another industry that grins ear to ear too. We’re talking about the luggage industry.

See, when people travel, they need their suitcases, trolley bags, and backpacks, right? And if you’re a keen observer and traveller, you would’ve noticed that the number of pieces coming off the conveyor belt in the past decade has risen tremendously. Gone are the days when a family of 4 travelled with 2 suitcases. Now everyone, including the kids, travels with individual bags.

And if you attended one of those 32 lakh weddings in December last year, you might have noticed at least 5–6 trolleys or suitcases being hauled about. They’re stuffed full with the bride’s and groom’s wedding attires. And not to forget that there’s the luggage that the bride and groom usually take when they move into a new home.

The end result? The luggage industry in India is having one of its best years ever.

And there’s one company in particular that’s poised to benefit from these tailwinds. We’re talking about VIP Industries, a name that’s synonymous with luggage in India. And a brand that dominates the organised luggage market with a 45% market share. In just the first 9 months of FY23, it has clocked the highest net profits in at least the past decade.

But getting here hasn’t really been an easy journey for VIP.

It all began in the 1970s. VIP started its journey with a capital of ₹1 crore and made briefcases priced at ₹50–100 for the office goer. This sturdy grey device was quite the rage for businessmen and political aides back in the day. And obviously, the name VIP gave it an aspirational high-status tag in young post-independent India too.

But things changed. The unorganized market mushroomed in a big way and started creating soft luggage with fabric. VIP specialised in hard luggage back then and didn’t foresee customer preferences changing. And while it launched a sub-brand called Skybags for soft luggage in the 1980s, it didn’t pump in enough money to build a brand and ward off competition.

Its market share began to drop.

Then came the liberalisation wave of the 1990s and it swept the rug from under VIP’s feet. Samsonite, a global brand, stepped into the Indian market. A new India with higher disposable income preferred a foreign brand over an ageing domestic one.

Its market share dropped further.

In between all this, VIP missed the memo that luggage wasn’t utilitarian anymore. It was a lifestyle product and a style statement. People didn’t want to be seen wheeling a boring brand. Luggage had become an extension of one’s personality and people didn’t mind shelling out the dough for what became oddly a status symbol.

And as its chairman, Dilip Piramal put it, “They [the customers’ want excitement. In my own circle, nobody uses a VIP product. In the beginning, I used to be a bit disappointed, but now I realise that if I was not the owner of VIP I would also not use its products.”

VIP’s market share tumbled from the 80% it once used to command to below 50%.

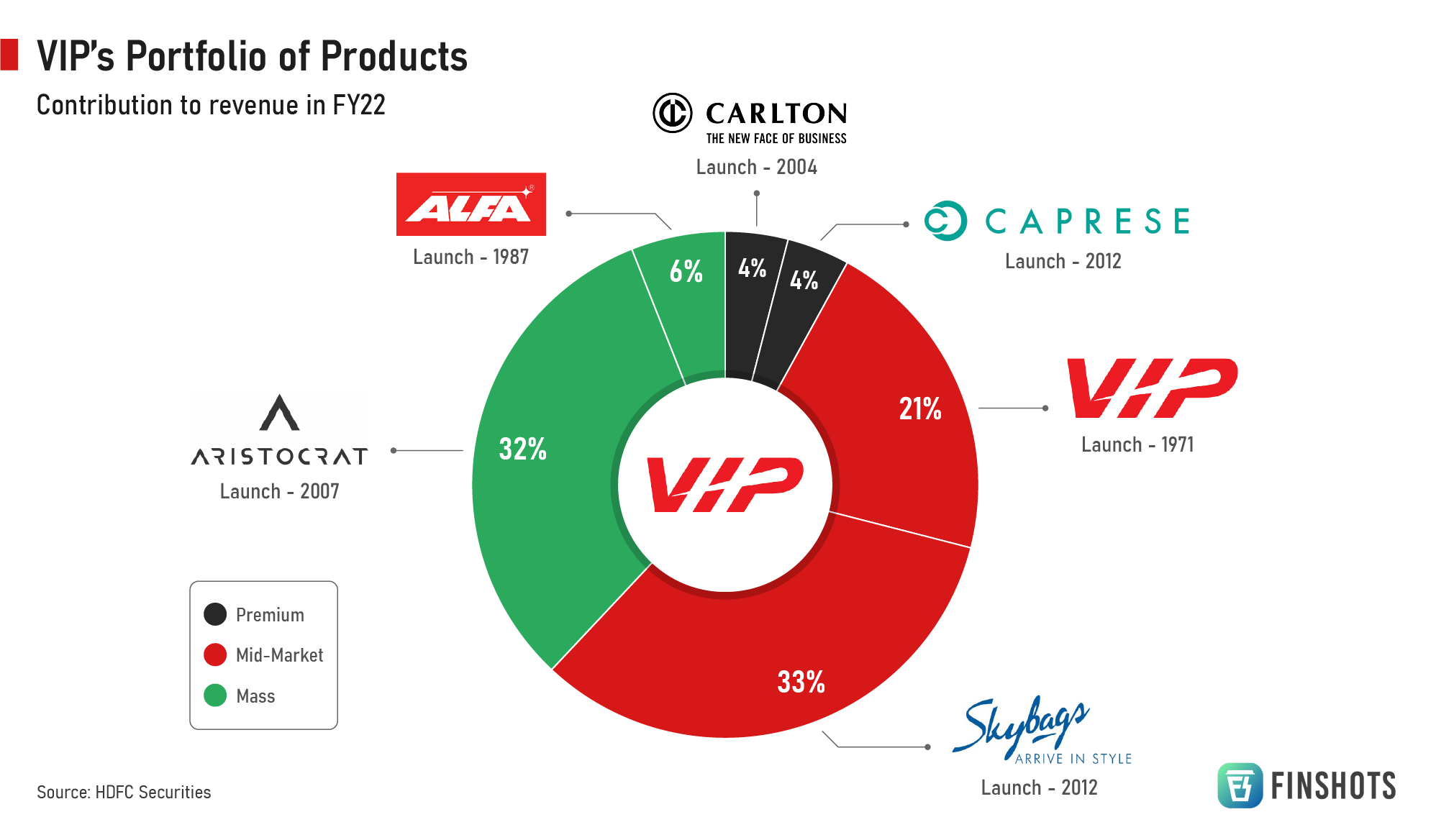

So, in 2008, when Radhika Piramal, the daughter of VIP’s chairman finally took the reins, she had her work cut out. She revamped the VIP image and positioned each brand distinctly. A brand called Carlton which VIP acquired in 2004 became the premium offering. Aristocrat was slotted into the mass market. She even brought back Skybags in 2011 but concentrated on design and vibrancy for the youth.

They also pumped up advertising. It jumped from around 4.7% of sales in FY09 to over 6.4% in FY18. Bollywood actors (Saif Ali Khan, Kareena Kapoor, Varun Dhawan) and Cricket stars (Rohit Sharma and Ravichandran Ashwin) were roped in for TV ads.

It also shifted its focus from selling only through its dealer channel to hypermarkets where people made impulse purchases. And soon enough, an entity like BigBazaar (while it was still around) actually contributed to 15% of VIP’s revenues.

All this meant their product mix also changed. Currently, the VIP brand contributes to 24% of the revenues, Aristocrat has a 32% share, and Skybags grabs the lion’s share with 33%

And you could argue that the runway is long for the company. Despite the introduction of GST, the unorganized market still holds a 60% share of the market. As India’s economy formalises even further, you could see unorganised vendors shrink and VIP will be in a sweet spot to pounce on their business.

The other thing is that the unorganised sector is known for churning out soft luggage variants. And there seems to be an increasing preference for hard luggage these days. Its market share is expected to rise from just 30% today to over 55% in the next few years. So even if GST isn’t the death knell, customer preferences can alter the landscape in favour of VIP quite quickly.

VIP seems to have got everything going for it.

But…there’s risk lurking in the shadows too. And that’s primarily in the form of competition.

We’re not just talking about Samsonite which has a 90% share in the premium segment. Or its sub-brand American Tourister which has captured people’s imagination in the mid-segment. The mass market features Safari Industries which has been around since the 1980s. While it doesn’t probably have as much brand recall as VIP, it doesn’t seem to matter in the mass market category. Safari seems to hit the sweet spot for India’s brand affinity and value pricing. And in the past couple of years, its market share in the mass market segment has risen from 19% to 26%.

Investors seem excited about Safari too. So in the past year, while VIP’s stock has risen only by 30%, Safari has returned a whopping 100%.

The other thing is that VIP’s bets on expansion haven’t played out as expected.

For starters, there’s the women’s handbag brand called Caprese. It was launched nearly a decade ago and it even roped in Bollywood star Alia Bhatt as its brand ambassador. But it contributes a measly 4% to VIP’s revenues. And while the management is certain that it’s a segment that they’re going to put all their efforts into over the next 5 years, the past experience doesn’t inspire a lot of confidence.

VIP’s international plans have also fallen flat. Back in 2017, it said that it planned to increase its exports to make up 25% of revenues, it is still stuck at a measly 5%. And while VIP is making noise about its intention to produce white-label luggage for retailers in the US and UK (which they can stamp with their own brand name), it’s too early to say how this will play out.

So yeah, while there are tailwinds in VIP’s favour, it may not be smooth sailing for the 50-year-old luggage brand.

Until then…

Don't forget to share this Finshots on Twitter and WhatsApp.

Ditto Insights: Why Millennials should buy a term plan

According to a survey, only 17% of Indian millennials (25–35 yrs) have bought term insurance. The actual numbers are likely even lower.

And the more worrying fact is that 55% hadn’t even heard of term insurance!

So why is this happening?

One common misconception is the dependent conundrum. Most millennials we spoke to want to buy a term policy because they want to cover their spouse and kids. And this makes perfect sense. After all, in your absence you want your term policy to pay out a large sum of money to cover your family’s needs for the future. But these very same people don’t think of their parents as dependents even though they support them extensively. I remember the moment it hit me. I routinely send money back home, but I had never considered my parents as my dependents. And when a colleague spoke about his experience, I immediately put two and two together. They were dependent on my income and my absence would most certainly affect them financially. So a term plan was a no-brainer for me.

There’s another reason why millennials should probably consider looking at a term plan — Debt. Most people we spoke to have home loans, education loans and other personal loans with a considerable interest burden. In their absence, this burden would shift to their dependents. It’s not something most people think of, but it happens all the time.

Finally, you actually get a pretty good bargain on term insurance prices when you’re younger. The idea is to pay a nominal sum every year (something that won’t burn your pocket) to protect your dependents in the event of your untimely demise. And this fee is lowest when you’re young.

So if you’re a millennial and you’re reading this, maybe you should reconsider buying a term plan. And don’t forget to talk to us at Ditto while you’re at it.

1. Just head to our website by clicking on the link here

2. Click on “Book a FREE call”

3. Select Term Insurance

4. Choose the date & time as per your convenience and RELAX!